The article below was taken from the business section of the November 25th edition of the New York Times. Due to the NYT policies you may or may not be able to view the full article with photographs so I have pasted most of it below. Here is a link to the NYT story. NYT Article

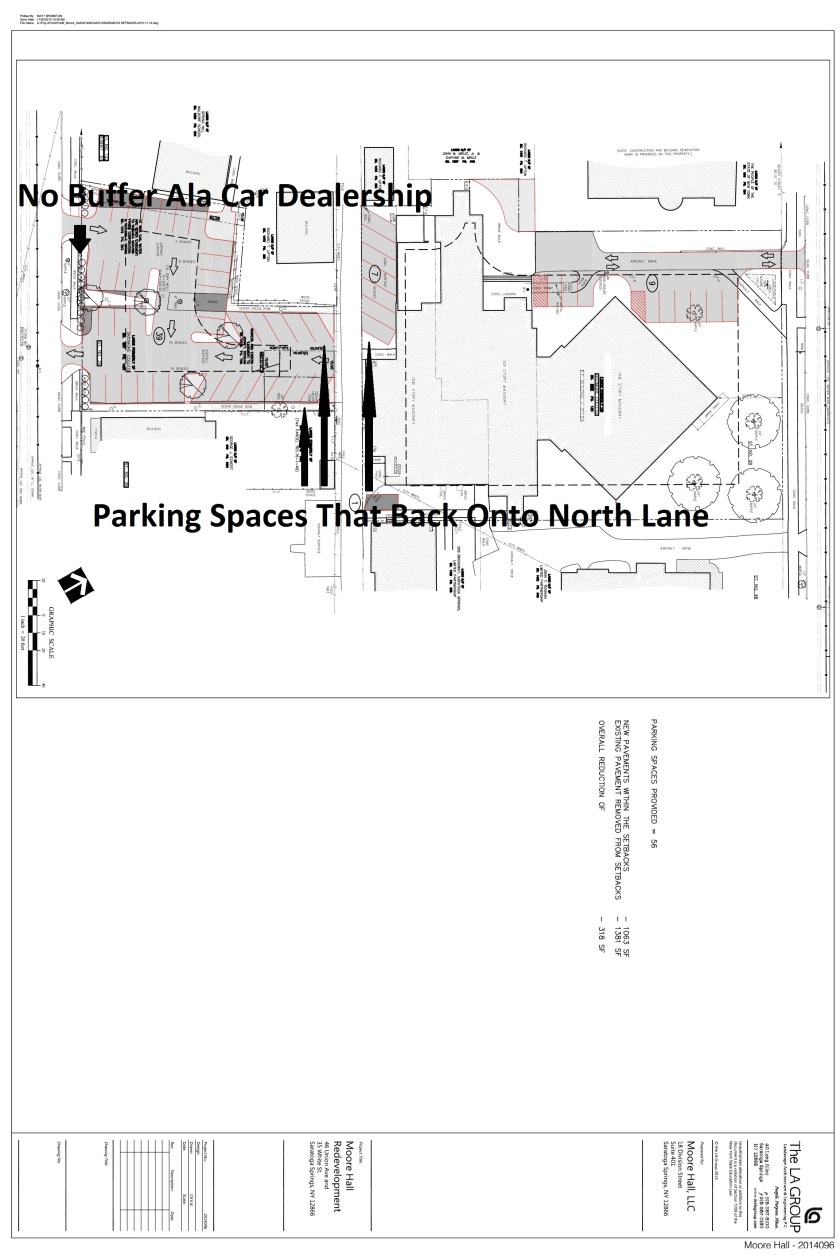

The gist of the story is that in absolute numbers there has been a decline in the number of golfers in the USA. It documents the fact that many courses are closing and that those that survive are diversifying. They are adding swimming pools, fitness centers, retail, hotels, etc. If this sounds familiar it is because this appears to be the path of our own Saratoga National Golf Course. This is the same project that originally promised the city how modest it would be and how well it would fit in with the low intensity character of our greenbelt. Clearly a very large camel’s nose has gotten into our city’s tent and the very large body is not far behind unless the community acts to defend its conservation district.

Golf Courses Forced To Reach Into Bag Of Tricks

By NICK MADIGAN NOV. 24, 2015

NOV. 24, 2015

BOCA RATON, Fla. — Weeds, crabgrass and fallen palm fronds cover the wildly overgrown greens of what was once the Mizner Trail Golf Club, its decrepit state emblematic of the fate of hundreds of golf courses around the country, many of them derisively known as “rabbit patches” or “goat farms.”

A short drive away, however, perspiring construction workers in yellow vests swarmed on a recent afternoon over the emerging structure of a 150,000-square-foot activities center, part of a $50 million renovation of the 44-year-old Boca West Country Club, home to some 6,000 residents, where fairways are newly planted and houses sell for as much as $5 million.

With the winter golf season beginning in Florida — the nation’s leader in golf courses with more than 1,000 — the extremes of failure and success point to a nationwide upheaval in the sport. It was booming when players like Tiger Woods reigned, but has since been roiled by changing tastes and economics, an aging population of players, and the vagaries of the millennial generation’s evolving pastimes.

There are about four million fewer players in the United States than there were a decade ago, according to the National Golf Foundation. Almost 650 18-hole golf courses have closed since 2006, the group says. In 2013 alone, 158 golf courses closed and just 14 opened, the eighth consecutive year that closures outpaced openings. Between 130 and 160 courses are closing every 12 months, a trend that the foundation predicts will continue “for the next few years.”

Dozens of private and public golf courses here in South Florida, and hundreds around the country, are in transition. Some courses have sought bankruptcy protection, while others have slipped into foreclosure. Many are under construction, with single-family homes and condominiums going up on land once dotted only with pin flags, sand traps and water hazards. Others have gone to seed as they await resolution of legal and zoning disputes.

Many clubs have survived by lowering sign-up fees and other costs, reducing the number of playable holes, and offering family-friendly amenities and activities that go far beyond hitting a ball with a 9-iron.

“Some courses are adapting, others are just not,” said Paul H. Chipok, a lawyer in Orlando who specializes in land-use and environmental issues. “It costs $100,000 a month to operate an 18-hole golf course — mowing the grass, fertilizing, regular maintenance. And that’s not including capital improvements. You need a lot of green fees to cover that.”

At private courses, members may be willing to pay more if necessary “because they expect a certain level of service,” Mr. Chipok said. “But courses that are open to the general public may not have the money to keep up their maintenance, and with less maintenance, the courses look worse and so they have to charge less to play on them. It’s a vicious cycle. This is the correction phase we’re going through now.”

Lesley Deutch, a senior vice president in the Boca Raton office of John Burns Real Estate Consulting, said the “old model” of private golf clubs with high initiation fees and “very exclusive” memberships is in decline.

“I don’t think the industry is over,” she said. “I think it’s just changing.”

In South Florida, where buildable land is fast disappearing, developers see golf courses as wasted space. Vast swaths of land that were once pristine courses in the middle of residential communities are becoming highly exploitable territory — prime opportunities for profits much greater than what fairways and putting greens can provide. As a result, the fallout of the downturn in the sport has been felt most keenly by residents of communities where the holes are no longer being played, primarily because the value of their homes often drops markedly once the course has closed.

“There are big issues, and they’re being fought and litigated,” said Steven M. Ekovich, a broker based in Tampa, Fla., who represents sellers of golf courses. “Homeowners paid a 20 or 30 percent premium for a golf-course lot, and suddenly a developer comes in and wants to build in front of them. There are big fights over that.”

A faded cart warning sign along the road leading to what once was the Mizner Trail Golf Course. Credit Ryan Stone for The New York Times

A few miles south of here, in Tamarac, the owner of the Woodmont Country Club, Mark Schmidt, faced stern opposition from some of the club’s homeowners to his plan for the course, which involved reducing the 36 holes to 18, putting up a four-and-a-half-acre commercial center, and building 152 single-family homes — in addition to the 1,900 houses already there. The plan was ultimately approved last year, but city officials have since balked at the owner’s proposal to build a 120-room hotel on the site.

“There’s always resistance,” said Mr. Schmidt, who bought the Woodmont property 10 years ago. “The cost of operating a golf course today is very difficult, so the land is being put to better use. As much as some people lost their views, others have gained better views. No point in allowing the land to remain fallow.”e Global Marketplace since 1968

Like other golf club owners who foresee an upside in expanding their offerings, Mr. Schmidt said he was building a new clubhouse and fitness center, as well as a new swimming pool. “Without these adjustments, golf would be in desperate trouble,” he said of the industry in general. “This is an absolute necessity.”

City officials in Tamarac have been dealing for years with turmoil on golf courses, particularly after the closures of the Monterey and Sabal Palm clubs. Three city commissioners were charged with receiving bribes from developers who sought to build houses on the properties, and there were numerous complaints that interlopers on motorcycles and all-terrain vehicles were racing around the weed-covered greens. Developers were eventually permitted to build hundreds of homes on the two former golf courses.

To prevent similar headaches on another property in Tamarac, the 275-acre Colony West Golf Club, the city itself bought the course in a 2011 short sale for $3.3 million. “We wanted to control the real estate,” Michael C. Cernech, the city manager, said of the championship course, which opened in 1971 as host to the PGA Tour’s Jackie Gleason Classic, now known as the Honda Classic. Under a five-year contract, management of the course was turned over in 2013 to the Virginia-based firm Billy Casper Golf, which runs about 140 courses nationwide.

Michelle F. Tanzer, a Boca Raton lawyer who represents resort developers and owners and sits on the board of the National Club Association, has helped country clubs adapt to what she said is growing demand for fitness facilities, resort-style pools, water parks and improved dining choices in places where previously only golf was the norm. The golf industry, she said, is “doing much better than it’s looked since 2009.”

The Boca West Country Club’s heavy investment in its facilities, Ms. Tanzer said, “is a perfect example of adapting” to the changing economics of golf. “They’re spending a fortune on making the place family-friendly,” she said. “It’s a home run.”

At Boca West, where it costs new members $70,000 to sign up, Jay DiPietro, the club’s 78-year-old president and general manager, suggested that the troubles besetting some of his competitors could be blamed on poor management and on their focus on “the business of selling houses.” But he operates on a different principle, he said.

“We’re in the people-pleasing business,” he said. “These people paid a lot to be here.”

Construction is taking place at Boca West in Boca Raton, home to some 6,000 residents, where fairways are newly planted and houses sell for as much as $5 million. Credit Ryan Stone for The New York Times

In any case, Mr. DiPietro said, the golf industry was vastly over-supplied with courses. “It was just waiting for a recession to knock the hell out of it,” he said. “The recession separated the boys from the men.”

Oliver K. Hedge, who appraises golf course properties for the real estate brokerage firm Cushman & Wakefield, said the golf industry had “made great strides” in shaking off underperforming courses in the last few years.

“A lot of clubs that have closed really should have closed,” Mr. Hedge said. “Florida is a good microcosm of the nation because we’re so dense with golf courses.”

Many of the closures, he said, have involved public and semi-private courses, the latter a reference to clubs that have an active membership program but that let non-members play for a fee.

In 2009, under what Mr. Hedge called “the prior economy model,” the Marsh Landing Country Club, a private course 300 miles north of here in Ponte Vedra Beach, Fla., charged a $100,000 initiation fee, 90 percent of it refundable upon resignation. Dues were $6,612 a year. Today, that same membership costs $25,000, but it is non-refundable, while annual dues have gone up to $8,400.

Still, golf clubs are “just scratching out a profit,” Mr. Hedge said from his office in Orlando. “Golf is a razor-thin industry from an investor standpoint. I hardly ever advise investing in a golf course. You’ve got to really know what you’re doing, and you’ve got to have a razor-sharp pencil. You might spend $20 million to $30 million to build a private country club — if you can clear 7, 8, 10 percent, you’re lucky. There are huge fixed costs. You could have a club that’s doing $10 million in revenue, but you’ve spent $9.9 million to get there.”

A developer known to be bullish on golf is the ubiquitous Donald J. Trump, who in 2012 added to his portfolio of 14 courses by purchasing two more in Florida, the Ritz Carlton Golf Club and Spa in Jupiter and the Doral Golf Resort and Spa near Miami. (Another renovated Trump course in Virginia has created a bit of a stir with a revisionist history of the Civil War.)

The price of the Jupiter resort — now known as the Trump National Golf Club — was not disclosed, although Mr. Trump’s company invested about $20 million in renovations for the course, clubhouse and amenities, according to Mr. Hedge.

The developer invested far more — some $250 million — in fixing up the four-course Doral resort, after buying it out of bankruptcy for $145 million. On Oct. 23, during a presidential campaign appearance at the resort, now called Trump National Doral, the candidate boasted of his negotiating skills in whittling $25 million off the asking price of the property.

“The key to the success of these ventures was the broader market timing,” Mr. Hedge said, referring to the two Trump resorts. “I assume they saw the luxury golf market returning, which it has done.”

Mr. Ekovich, the golf-course broker in Tampa, was slightly less positive in his estimation of the market’s strength.

“Revenues are up a little bit, and so are rounds,” said Mr. Ekovich, who noted that during the years of the recession the price of some golf courses had “cratered” to about half their former value. “Things are moving in the right direction, but they are by no means meteoric rises.”