I submitted a FOIL request of the New York State Police for the investigation they performed into the Saratoga Springs’ On-Call scandal. After many months, I finally received the investigation report. For readers unfamiliar with the scandal that precipitated the investigation, here is the link from an earlier post. There are actually multiple posts on this fiasco. Using the search function in the blog, search for “on-call” for more stories.

The investigator from the State Police was Andrew Werner, who has since retired. Werner did an excellent job of determining what happened and who might be culpable.

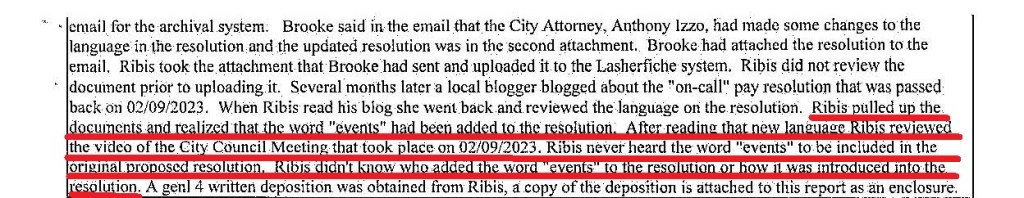

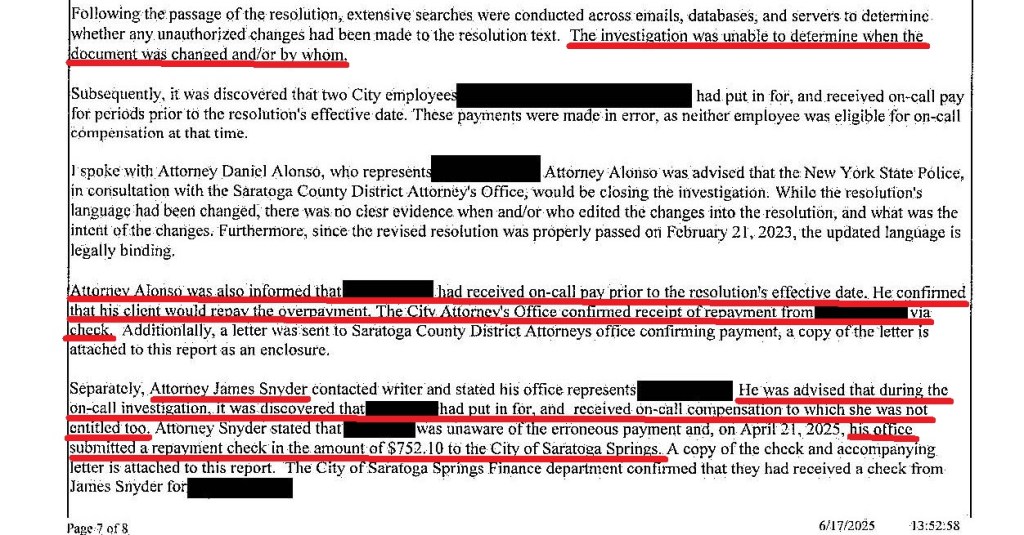

The investigation confirmed that someone altered the resolution authorizing on-call pay for deputies, but Werner was unable to determine who changed the resolution, so no one was charged.

Nevertheless, the investigation did include some interesting revelations.

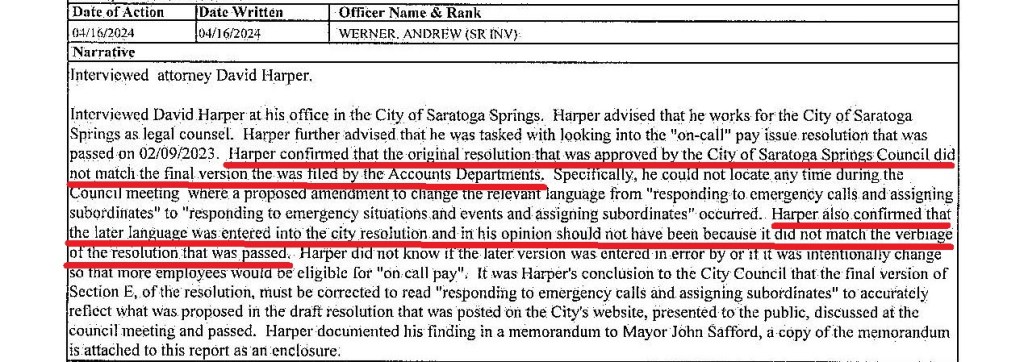

City Attorney David Harper Confirmed that The Council Resolution Posted As The Official Record Of The Meeting Was Inconsistent From The Video Record Of The Meeting

Classic Lying By Accounts Commissioner Dillon Moran

Those of us who have dealt with former Accounts Commissioner Dillon Moran are acquainted with his bizarre pattern of lying about things when the embarrassing truth exposing his lying is readily available.

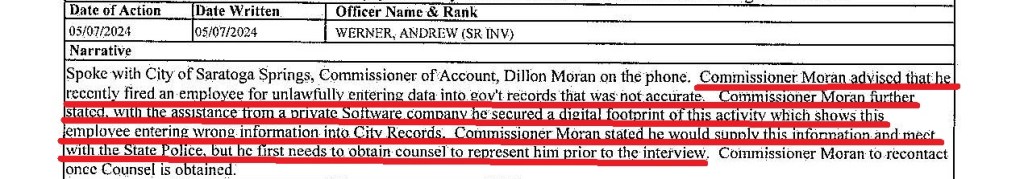

In this case, Moran contacted Werner, telling him that he had a report documenting who had doctored the resolution. He claimed that it was done by an employee in his department whom he had fired.

Falsehood number one was that the late Lisa Ribis, the employee, was fired. I have documented Moran’s cruel obsession with harassing Ms. Ribis. In fact, Ms. Ribis was protected under civil service. He was only able to suspend her with pay pending a hearing on his charges. Ms. Ribis was highly regarded in City Hall. John Franck, who served as Accounts Commissioner, told this blogger of his high regard for Ms. Ribis. This same post chronicled Moran’s harassment of Ms. Ribis.

Before her hearing could be convened and after months being suspended with pay, Ms. Ribis was diagnosed with cancer. Having served the city for decades, she was able to retire, and the charges against her were dropped. Lisa Ribis was never fired.

According to the police report, Moran told the investigator in a telephone call that an outside computer company had investigated the matter and issued a report documenting that Ribis was the perpetrator.

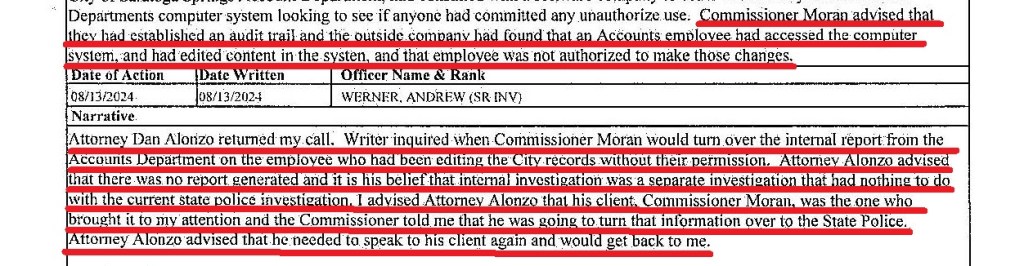

When the report was not forthcoming, the investigator contacted Moran’s attorney to ask when Moran would be turning it over.

Attorney Dan Alonzo returned my call. Writer[Werner] inquired when Commissioner Moran would turn over the internal report from the Accounts Department on the employee who had been editing the City records without their permission. Attorney Alonzo advised that there was no report generated and it is his belief that internal investigation was a separate investigation that had nothing to do with the current state police investigation. I advised Attorney Alonzo that his client, Commissioner Moran, was the one who brought the report to my attention and the commissioner told me that he was going to turn that information over to the State Police. Attorney Alonzo advised that he needed to speak to his client again and would get back to me.

State Police Report

Moran never produced the report because it never existed and he made the whole thing up.

The Improper Payments And Missing Restitution

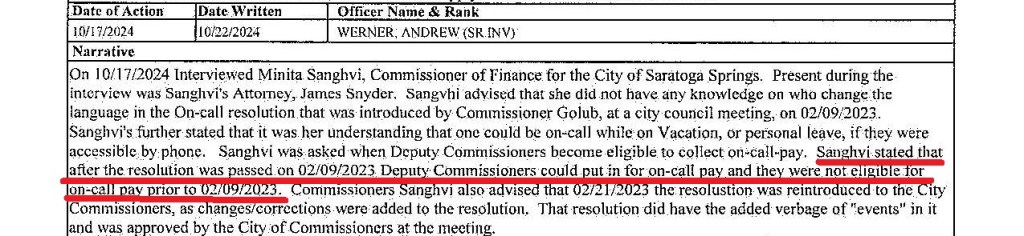

While the investigation was unable to determine who doctored the minutes, it did reveal that two deputies had been improperly paid. The redacted names of these deputies were Stacy Connors, Moran’s deputy, and Angela Rella, Mayor Ron Kim’s deputy. The resolution language authorized that the benefit would become effective in mid-February. These two women submitted requests for payment for the prior six weeks and were paid by the Finance Department, despite the resolution not authorizing it.

The attorneys representing Rella and Connors acknowledged the improper payments, and the city subsequently received checks representing restitution.

Then Finance Commissioner Minita Sanghvi acknowledged to Werner that the two women were improperly paid. These checks were never deposited in the city’s accounts. Readers who follow this blog will remember that this blogger made numerous attempts to find out from Sanghvi why she never deposited them. To this date, Sanghvi has never been willing to explain to the public why she allowed these women to keep their ill-gotten gains.

Moving On

As Moran and Sanghvi are no longer on the Council, all of this ends up being moot, except hopefully, their careers as elected officials on the City Council are over.