[I received this essay from Lew Benton. This year was not the first time Sanghvi has mishandled the budget process. Lew goes back to 2023 to detail how Sanghvi failed to follow best practices and charter requirements in putting together the 2024 budget. He notes also her penchant for consistently overestimating revenues and underestimating expenditures which has contributed to today’s dilemma. ]

Why Make the Proposed City Budget Opaque?

Perhaps some of those who attempted to review the City’s October 27 amended Comprehensive Budget, and compare and contrast it to the Finance Commissioner’s initial October 3 presentation, came away as perplexed as Alan Turing in his early efforts to crack the Enigma Code.

If you did, you were not alone. Unlike all previous City budgets, the proposed amended 2024 budget does not adhere to the format required by the City Charter.

Rather than, as outlined in the Charter, follow a standardized budget format that employs “ … the most feasible combination of expenditure classifications by funds, organization unit, program, purpose, or activity and object,” all proposed expenditure lines are lumped together, not disaggregated by function.

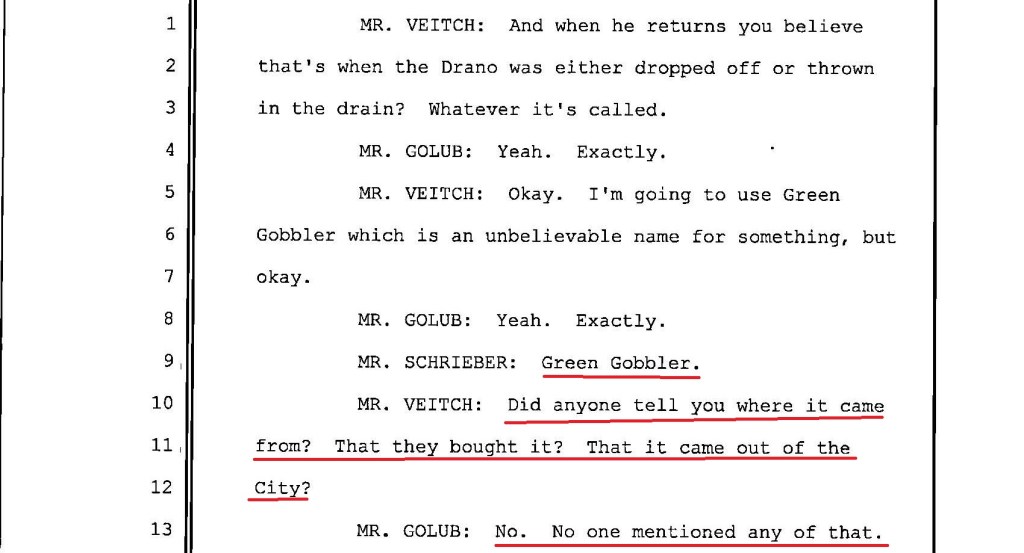

The table below presents the City Attorney’s Budget as it appeared in the proposed 2024 Comprehensive spending plan dated October 3, 2023. The expenditure budget for each of the departments under the mayor’s administrative control follows the same format, as does each organizational unit or function in Finance, Accounts, Public Safety and Public Works.

CITY ATTORNEY’S OFFICE

PERSONAL SERVICE 2022 2023 2023 2023 2023 2024

Original Adopted Revised Actual Projected Comprehensive

A301142151047 FOIL OFFIC .00 .00 .00 .00 .00 .00

A301142151090 CITY ATTY 89,493 93,600 93,600 71,742 93,857 93,857

A301142151110 ASST ATTY .00 .00 82,548 57,743 82,549 105,276

A301142151117 AST CITY A .00 .00 .00 .00 .00 .00

A301142151276 EXASSISTAN 53,496 54,566 57,297 43,796 57,297 59,550

A301142158030 SS CITY PO 10,913 16,689 23,004 13,059 17,878 19,789

TOTAL PERSONAL SER VICES 153,902 164,855 256,449 186,342 251,581 278,473

EQUIPMENT AND CAPITAL OUTLAY

A301142252200 OFFICE EQ 1,360. 00 .00 .00 .00 .00

TOTAL EQUIPMENT AND CAPITAL 1,360. 00 .00 .00 .00 .00

CONTRACTED SERVICES

A301142454110 OFFICE SUP 3,019 700 700 559 700 700

A301142454120 POSTAGE 346 350 355 355 355 350

A301142454250 CONF REG 509 1,500 870 107 870 .00

A301142454440 BOOKS 1,195 1,300 2,044 943 1,687 1,300

A301142454671 PHONE FAX 31 .00 216 170 216 .00

A301142454720 PROF SER 92,816 20,000 56,250 33,049 92,312 20,000

A301142454740 SC EQUIP 2,163 2,050 2,050 1,335 2,050 2,050

A301142454745 LEGAL LIAB .00 .00 .00 .00 .00 .00

A301142454760 LEGAL 500 750 750 500 750 750

TOTAL CONTRACTED SERVICES 100,581 26,650 63,236 37,020 98,941 25,150

TOTAL CITY ATTORNEY 255,844 191,505 319,686 223,363 350,523 303,623

This format allows ease of access and review of the proposed budgets of each city function, identification of and individual expenditure for each title, non-personal costs and costs of associated contractual expenses. Further, this format – required by Charter law – shows the total costs for each expenditure classification.

In this example, it is noted that the Council has significantly overspent the “PROF SER” line this fiscal year and last. This should beg the question of why over $90,000 has been spent in 2022 and 2023 on outside legal services while only $20,000 was initially budgeted. And why only $20,000 is proposed for 2024.

Is this an anomaly? Were there unanticipated extra-legal services in 2022 and 2023 that will not be necessary in 2024? Of course many other similar observations are made in the review of essentially all departmental budgets.

This required budget presentation is transparent, relatively simple and allows and encourages understanding. The amended budget is opaque.

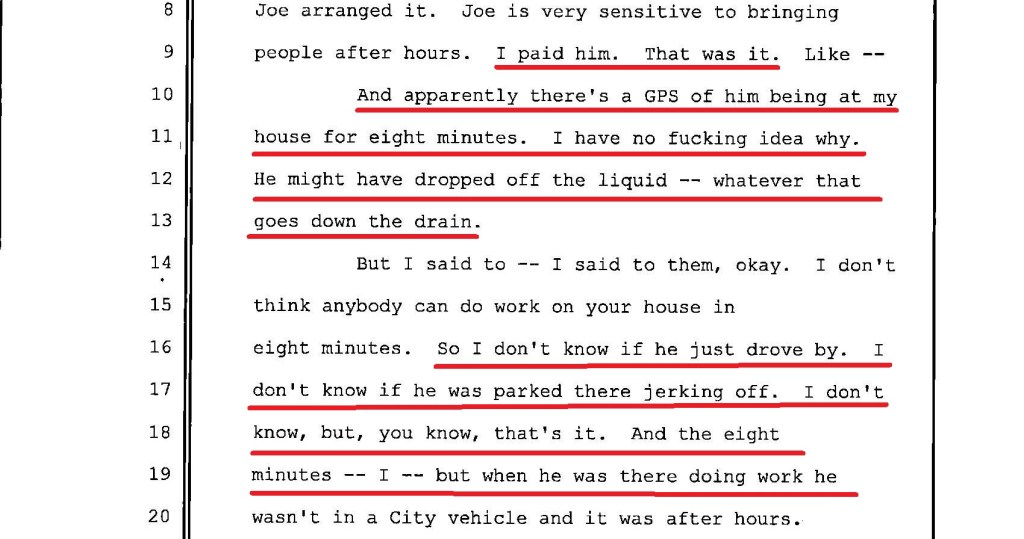

Without explanation, however, the proposed amended 2024 Comprehensive Budget is presented in an entirely different form.

For example, the several “department” expenditure lines under the auspices of the mayor are simply thrown together, co-mingled. The reviewer is left to divine which line items are part of which of the mayor’s several department budgets: i.e., City Attorney, Planning, Building, Human Resources, etc.

The same is true for Finance, Accounts, Public Safety and Public Works. In the later two, Public Safety and Public Works, the task of meaningful, comprehensive review of the budgets of discrete functions: i.e., fire services, policing, EMS, etc., requires substantial investment in time and enough working knowledge to assign each line item to its respective agency.

In the Mayor’s proposed budget there are at least seven expenditure lines alone labeled “Professional Services” but the only way to determine which department the lines apply to requires a time consuming and tedious matching of account numbers.

Why Finance elected to abandon a budget format that has always been relatively easy to read and understand for one significantly more difficult to puzzle out is itself a conundrum. Finance must be required to reformat the proposed amended budget before its November 28 hearing.

Other Thoughts on the Proposed 2024 City Budget. Certain Revenues

and Expenditures

The proposed 2024 City Comprehensive Budget as presently constructed is concerning. It will require significant amendments if operating deficits are to be avoided next year.

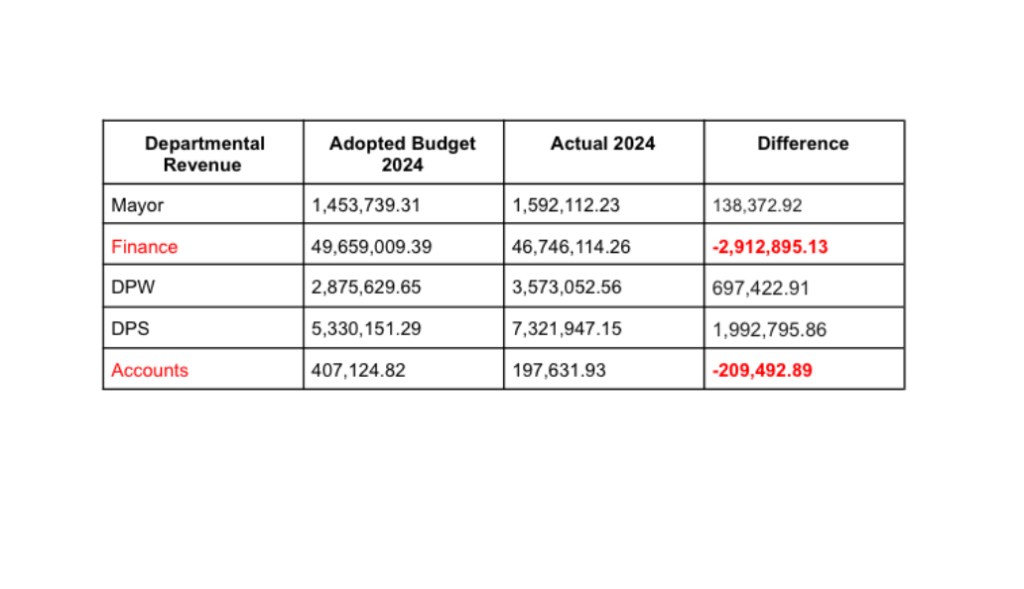

First and foremost, it includes unfavorable budget variances in both major revenue and expenditure accounts.

This comes on the heels of a 2023 budget, the first prepared and adopted by current City Council members, that preordained the 2024 proposal’s many overstated anticipated revenues and, in some cases, grossly underfunded expenditure lines.

The proposed 2024 operating budget is not in balance and must not be adopted until it is. To bring it into balance will require a more realistic examination of several accounts, including those referenced below, and the political will to act.

No doubt, the lack of institutional knowledge and limited understanding of how this government functions on the part of a Council made of first term members can, in part, serve to temper the inadequacies in the 2023 budget. But failure to recognize and correct them going forward is unacceptable and a violation of the fiduciary’s responsibility.

Attempting to transfer blame to those who had no hand in the adoption of the 2023 budget or the preparation of the 2024 plan, citing recent high inflation and the dearth of new revenue streams for the city’s fiscal difficulties rings hollow.

All local governments are faced with the same head winds. It might be more honest to acknowledge that hiring additional non-essential employees was not prudent, that budgeting non-existent revenues e and that deliberately low balling major expenditures invites deficit spending.

Following are examples of the unfavorable variances in the proposed 2024 operating budget. There are, to be sure, others.

Revenues

In Finance, $850,000 in Hotel Occupancy Tax revenue is proposed for 2024. This is over $100,000 more than was actually realized in FY 2022 and over $600,000 more than has been received to date this year.

The 2023 budget includes a non-existent ‘Cannabis Tax’ revenue of $250,000. The proposed 2024 budget carries that same amount forward. Potential first time revenues such as this one do not usually meet expectations. And by prematurely including the revenue in the 2023 budget only added to a negative revenue variance

The proposed Mortgage Tax revenue for 2024 is $1.5 million compared to the $933,400 collected to date this year. The $933,400 is far below the $2.05 million budget.

Mortgage markets have been depressed even here in Saratoga Springs by Fed attempts to reign in inflation. Even the $1.5 million proposed seems unrealistic.

The Mayor’s budget is ripe with unfavorable 2024 revenue variances. The Building Permit account carries a proposed $700,000 revenue even in the face of a major decline in permit revenues this year. To date Building Permit revenue is listed by Finance at $352,520 with only $400,000 projected by the end of the FY. This is $300,000 less than was budgeted. Artificially inflating anticipated revenue only increases the structural deficit.

In recent years this revenue has been strong but, at least for the short term, it is most unlikely that in one year that revenue will increase 75%, from $400,000 to $700,000.

Likewise, Planning Board fees are unrealistically overstated. Actual 2022 Planning Board revenue was $122,820. Still, this revenue line was increased to $200,000 in the adopted 2023 budget but is now projected by Finance to fall $35,000 short.

Now, in spite of the anticipated 2023 unfavorable variance, Finance has increased the line to $250,000 for 2024. Perhaps an explanation for this doubling of the 2022 revenue and increasing the anticipated 2023 collections by $85,000 in the 2024 budget is in order.

Other revenue lines in the Mayor’s budget that are suspect include Insurance Reimbursement, from -0- this year to $125,000 next year.

The Public Safety revenue budget includes a $300,000 increase in Ambulance Transportation charges over the $2 million projected to be realized by the end of FY-23 and is over $500,000 more than actually collected in 2022.

Unless the fee structure has been significantly increased this revenue line is likely to fall far short of the $2.3 million in the proposed 2024 budget.

Parking Enforcement revenue is now anticipate to be $462,0000 this year, down almost $80,000 from the $540,000 budgeted and $38,000 less than the $500,000 in the 2024 proposal.

Operating Expenditures

The operating budget also includes many likely unfavorable variances. Just as overestimating revenues in the actual 2003 and proposed 2024 budgets contributed to the city’s present fiscal dilemma, so have what appears to be unfavorable variances in the operating budgets.

In the 2023 Public Safety operating budget the City Council included $190,000 for Fire Fighter Overtime. Finance now projects that by the end of the fiscal year $533,500 will be spent, this is an astronomical increase of $343,500 over the amount budgeted.

Similarly the Firefighter Compensation Time budget is anticipated to be overspent. Only $190,000 was earmarked for this line in the 2023 budget but $563,000 is anticipated to be spent by year’s end, a $373.000 overage.

So too is the proposed 2024 Police Overtime and Compensation Time lines grossly underfunded. Finance proposes to appropriate the rather odd amount of $263,637 for Compensation Time vis a’vis the $483,570 spent in 2022 and the projected $450,000 in 2023. The 2024 OT line is set at $325,000 against the $507,505 expended in 2022 and the estimated $450,000 this year.

In the aggregate, Finance is proposing 2024 Police and Fire Fighter OT and Comp Time expenditures totaling $1,338,637 although corresponding 2022 costs were $1,498,271 and projected 2023 expenditures are $1,981,000.

While there may have been unique circumstances that have resulted in higher than normal Police and Firefighter OT and Compensation Time expenditures this year, the proposed 2024 appropriations are well below what will be needed to avoid the necessity of transferring large amounts during the course of FY 24.

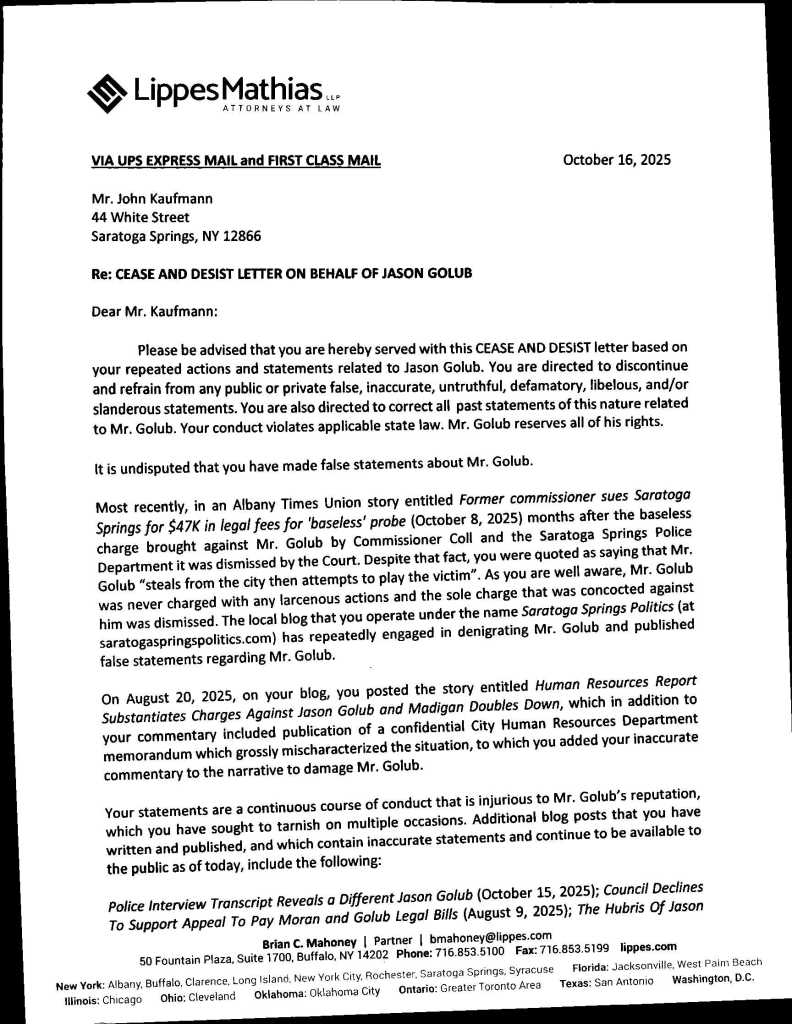

In the Mayor’s office $20,000 was budgeted for outside legal counsel this year but Finance projects that over $92,000 will be spent. Only $20,000 is earmarked for next year. Now it appears that yet more outside legal services will be retained to investigate an offending mail. This is madness.

These references are not all inclusive. There are many more questions to be asked and answered. Why, for example has Code Blue shelter support been cut from the budget.

There is time to prepare a more realistic 2024 operating budget. I hope the City Council will do so lest the new Council be bequeathed an extraordinary fiscal challenge.

Lew Benton